Simplify Global Trade Compliance with Automated Workflows

Gain complete control over global trade compliance, cross-border regulations, and audits with Trademo's Global Trade Compliance Solution. From managing thousands of SKUs to navigating tariffs and export controls, our intelligent, centralized solution keeps you audit-ready and compliant—every step of the way.

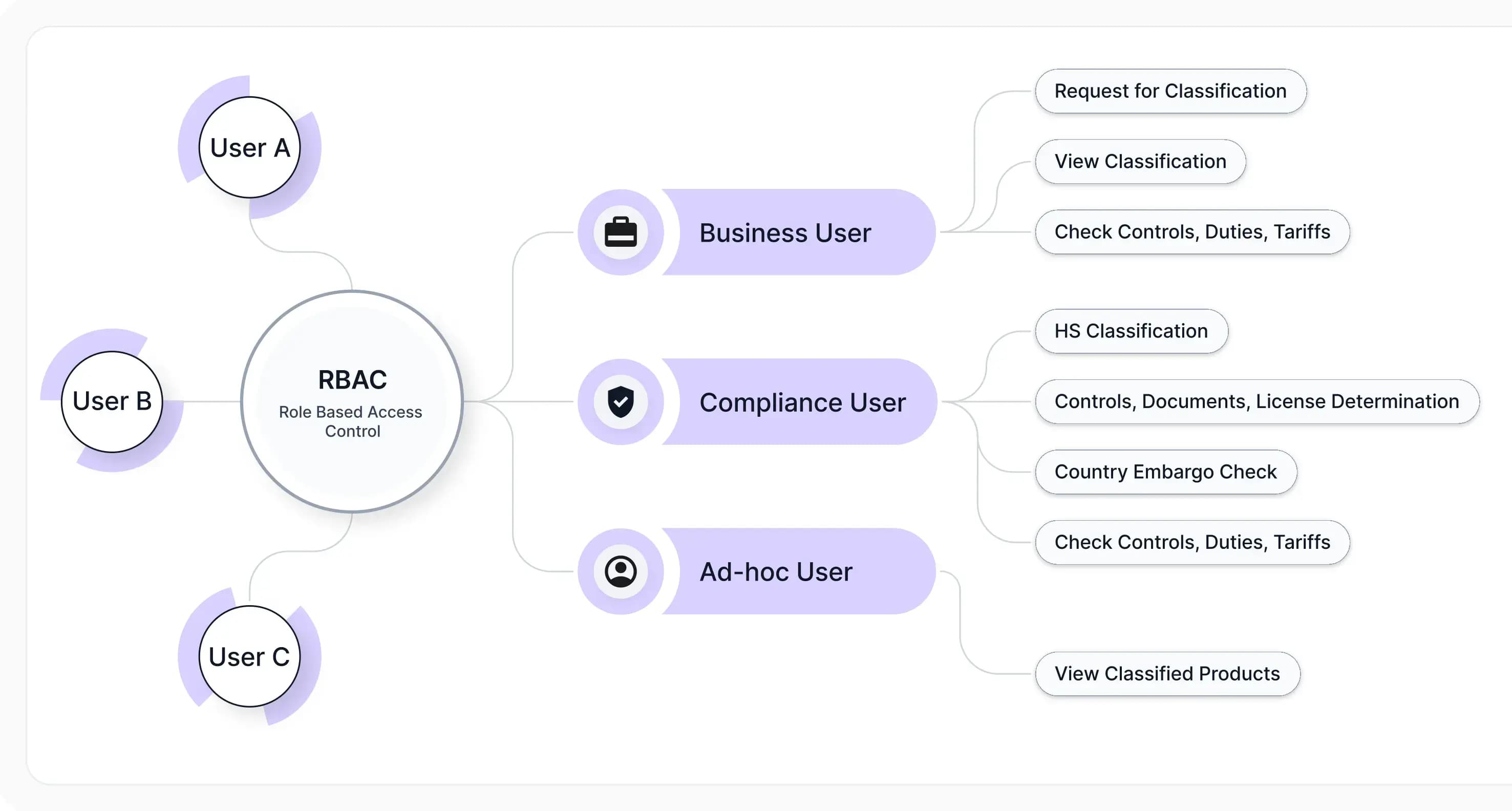

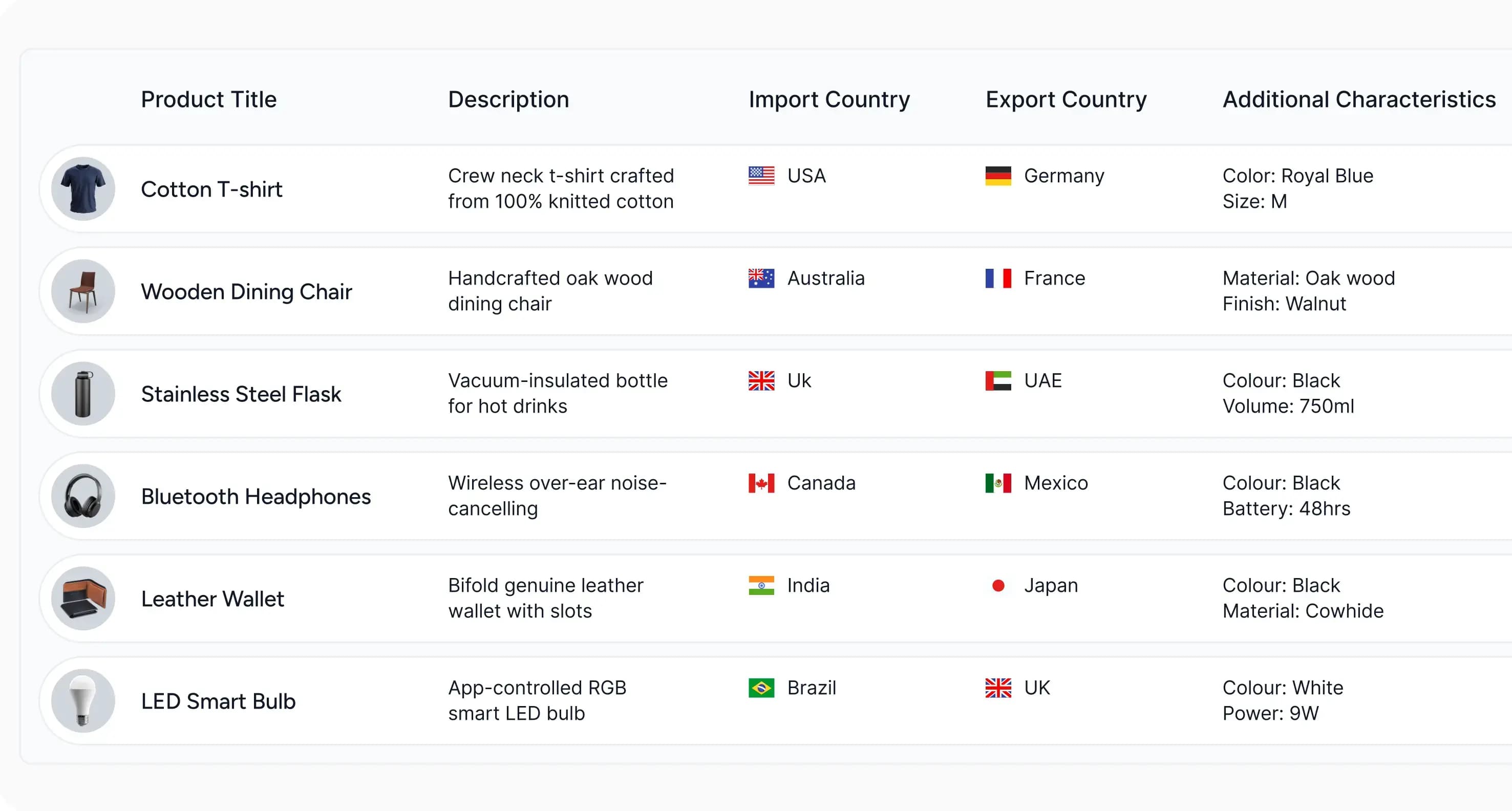

Ensure Global Trade Compliance with Automated HS Classification, Master Data Management and Automated user workflows

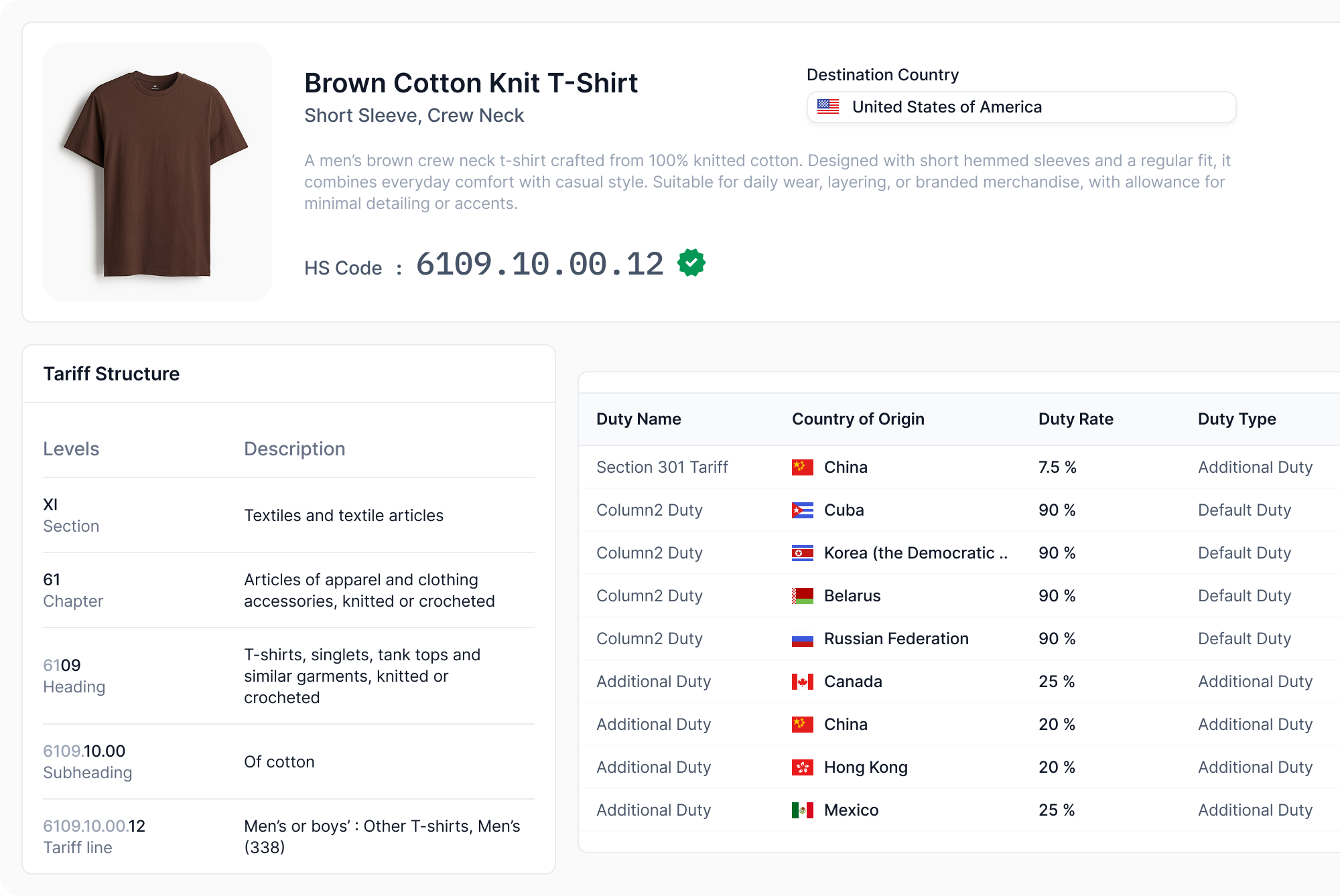

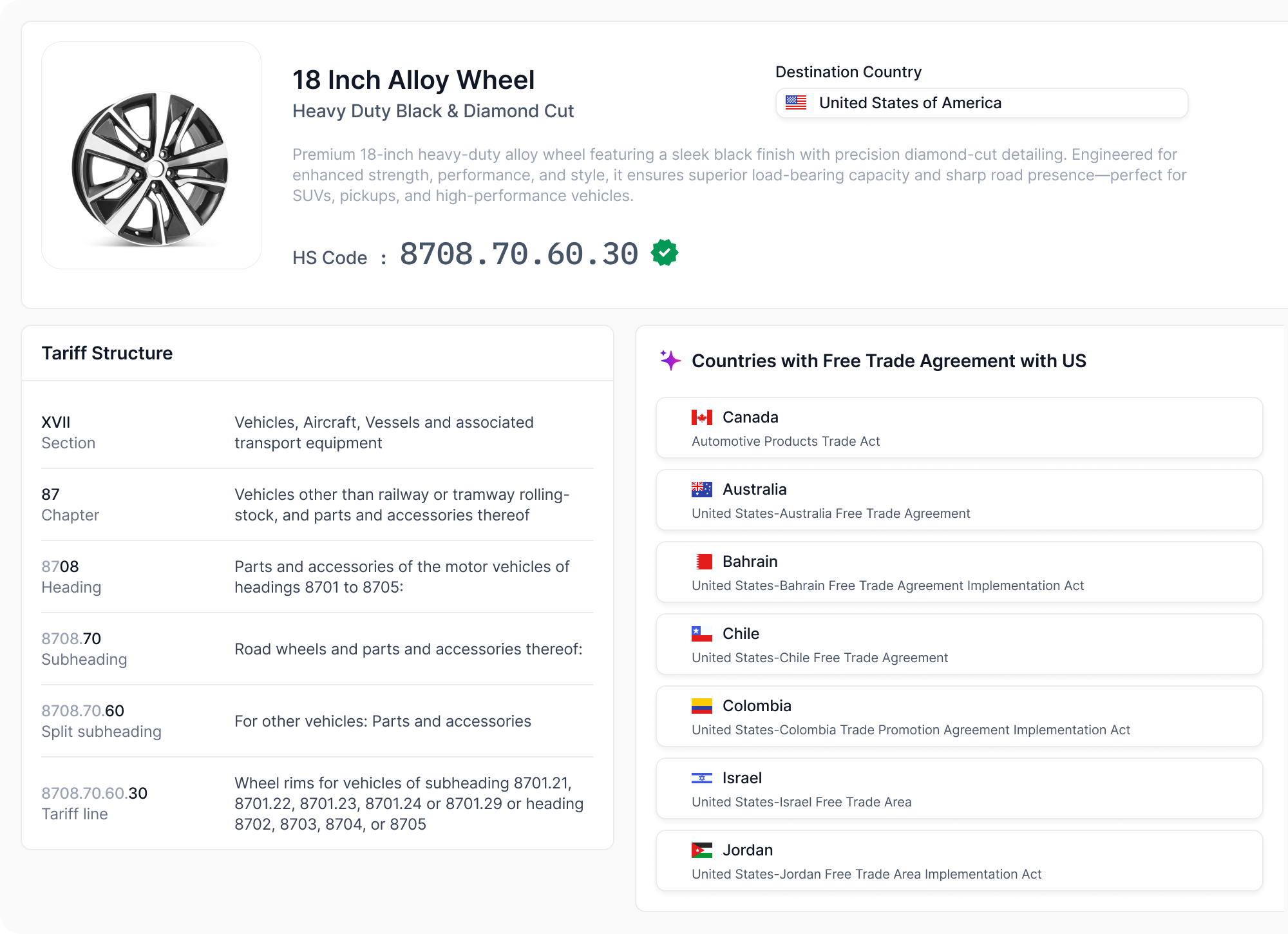

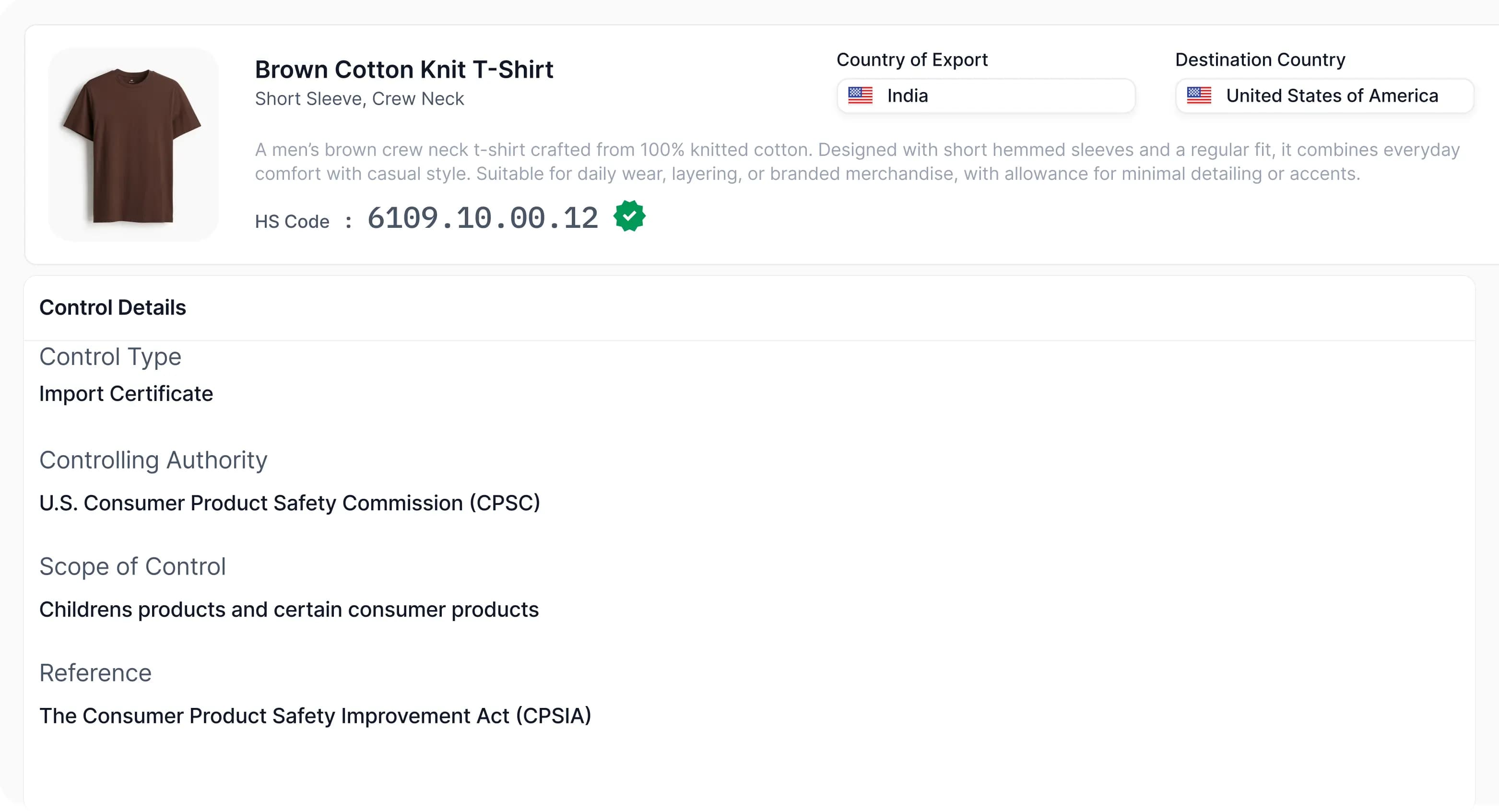

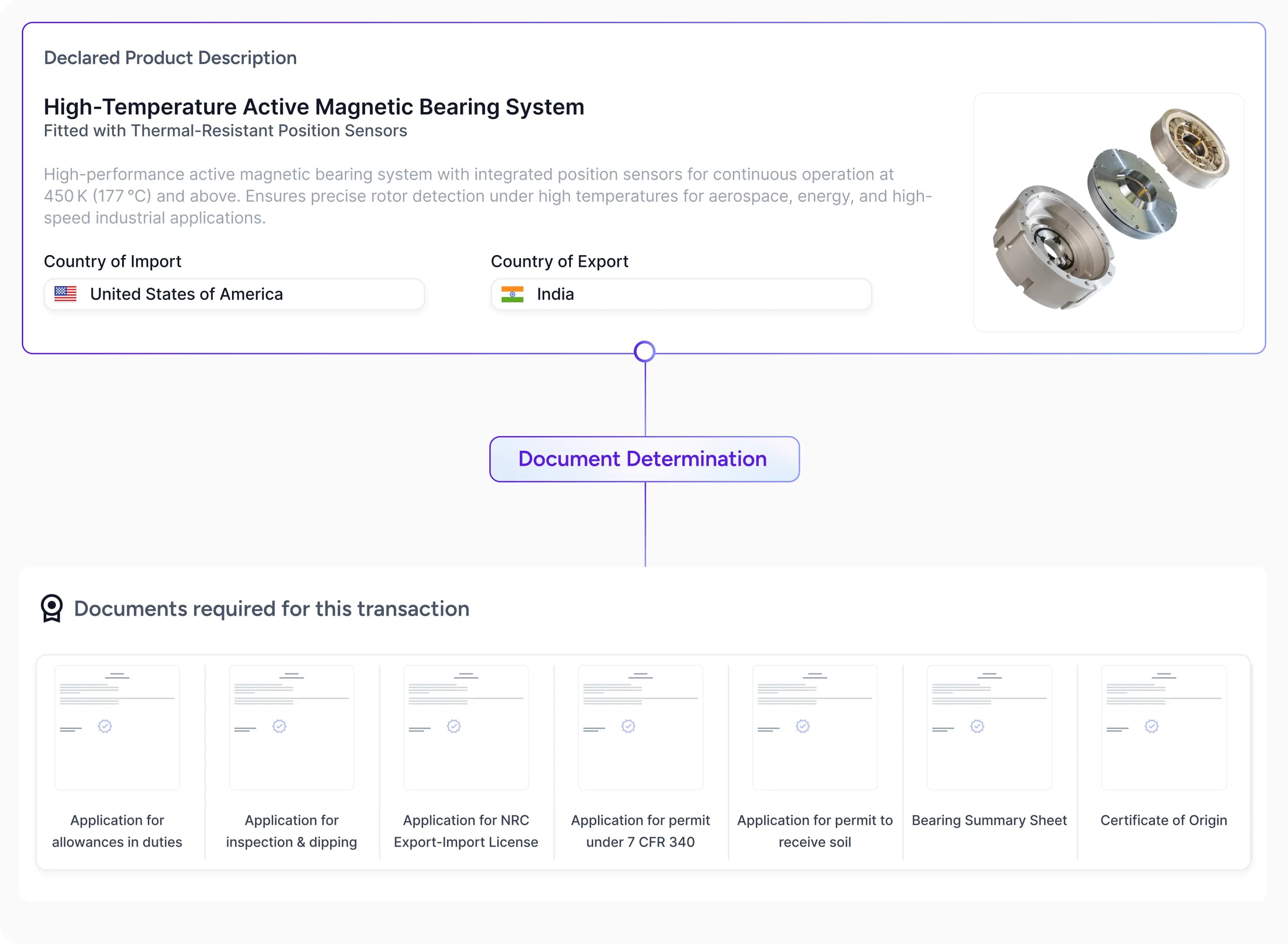

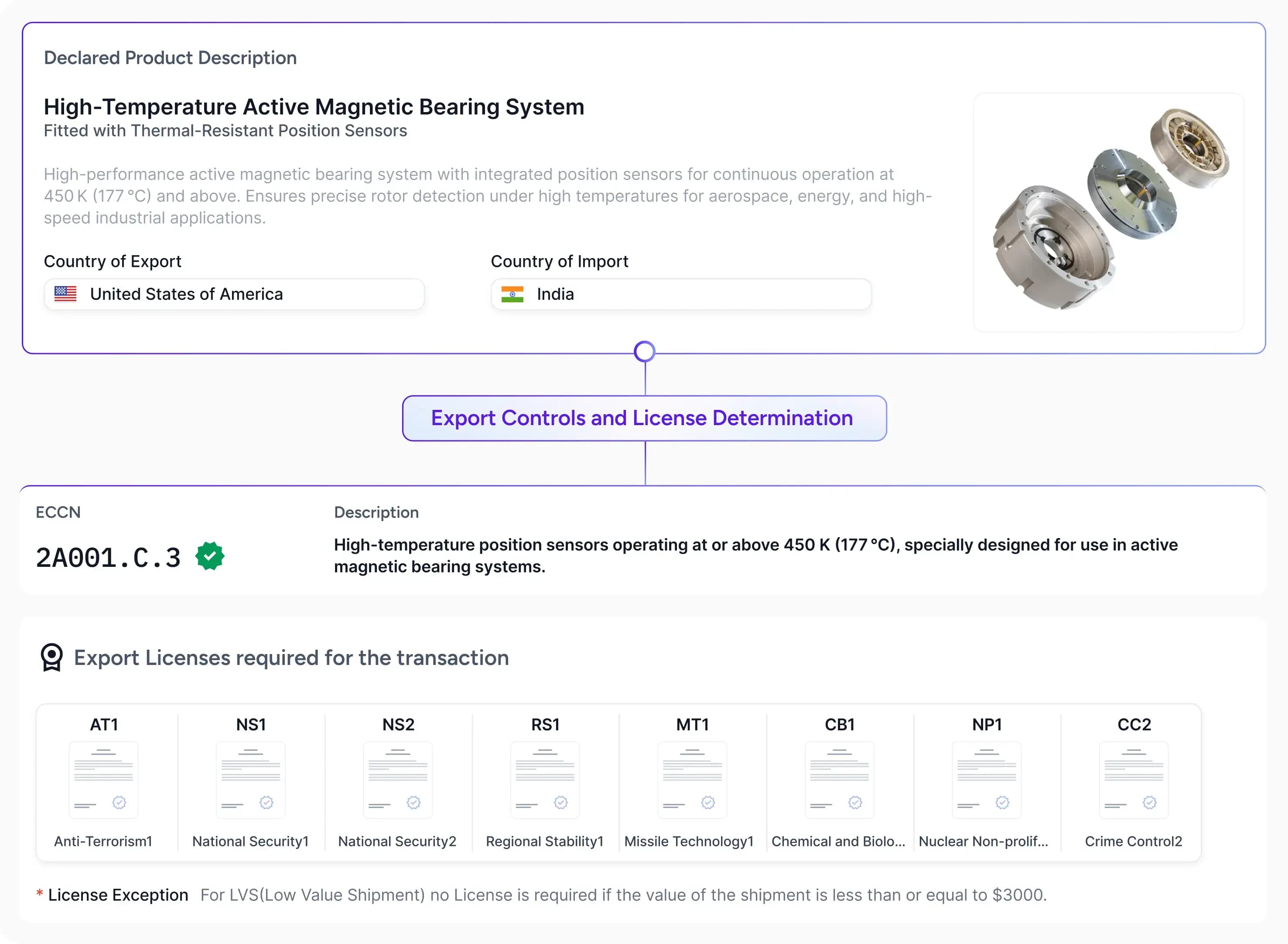

Ensure Global Trade Compliance with Duty Intelligence and Document Determination

End-to-End Global Trade Compliance Suite

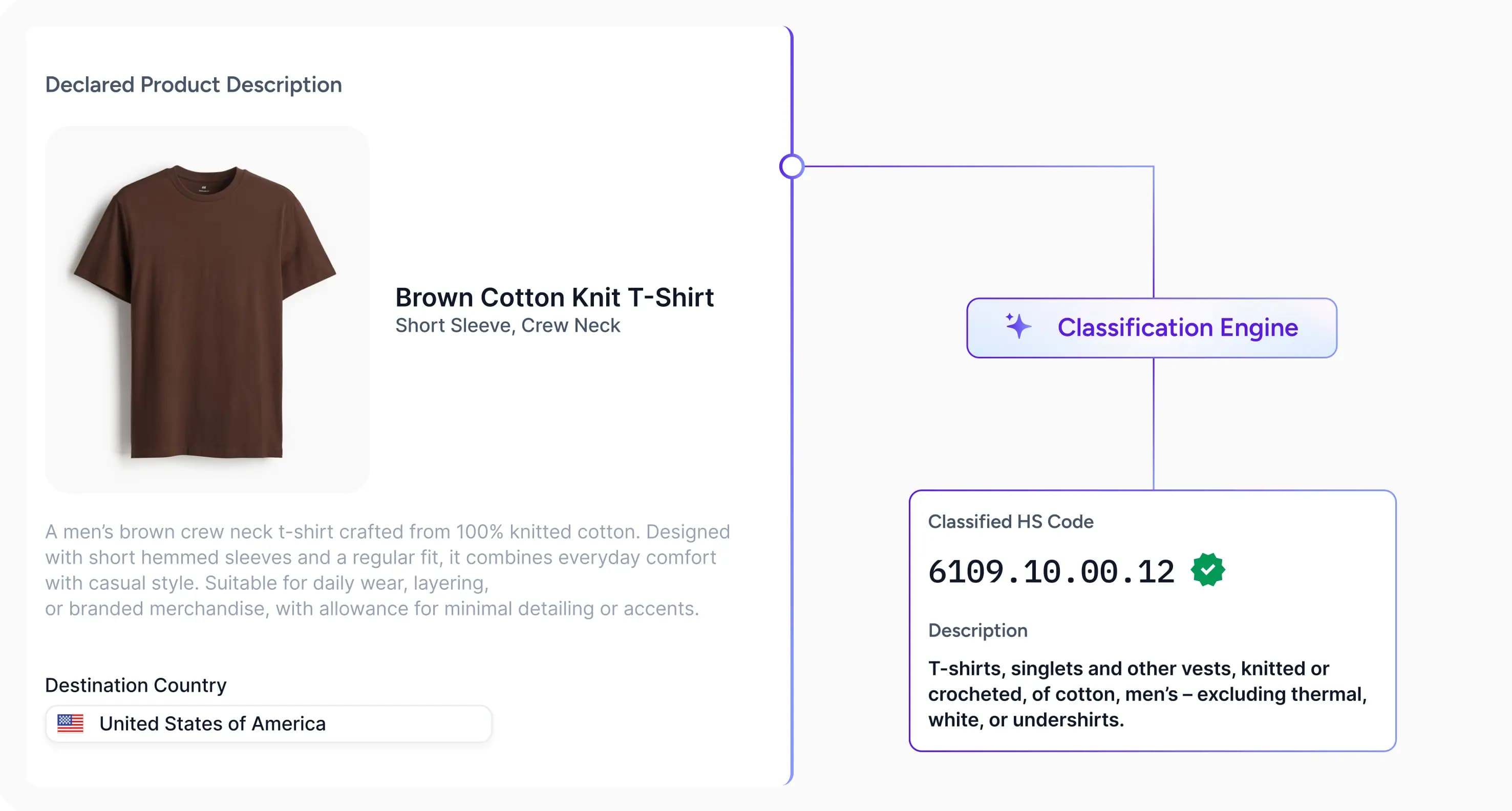

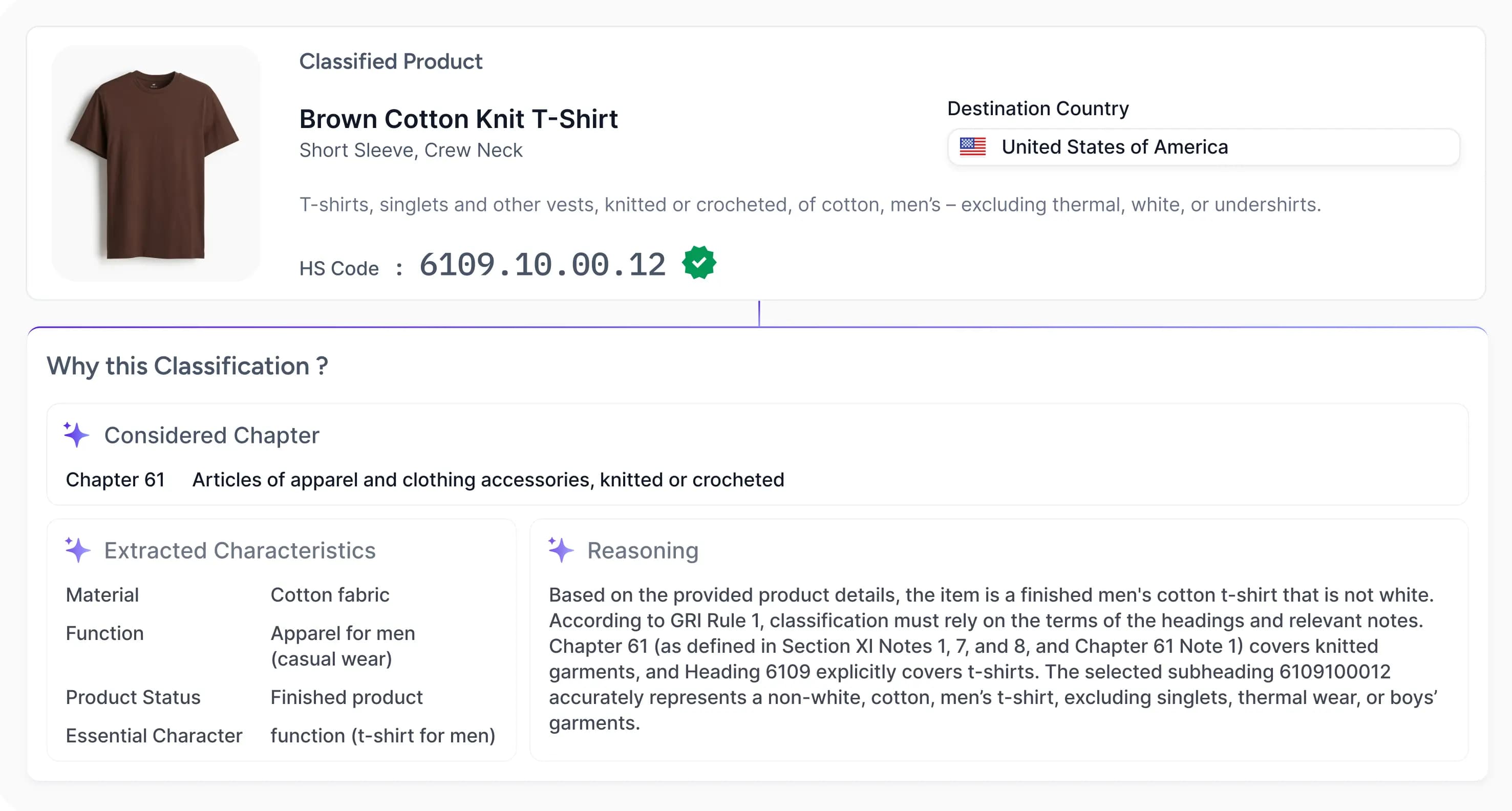

HS Classifier

Trademo’s HS Classification Tool combines advanced AI with deep trade expertise to deliver precise, country-specific HS codes quickly and reliably. It interprets product context, applies global and local tariff rules, and provides audit-ready justification—helping businesses reduce errors, speed up customs clearance, and ensure full compliance at scale.

ExploreGlobal Trade Content

Trademo Global Trade Content offers comprehensive, real-time trade data from over 140 countries, including tariffs, duties, customs rulings, and regulatory updates. This centralized resource empowers businesses to navigate complex trade compliance, minimize risks, and make informed decisions with up-to-date, country-specific intelligence worldwide.

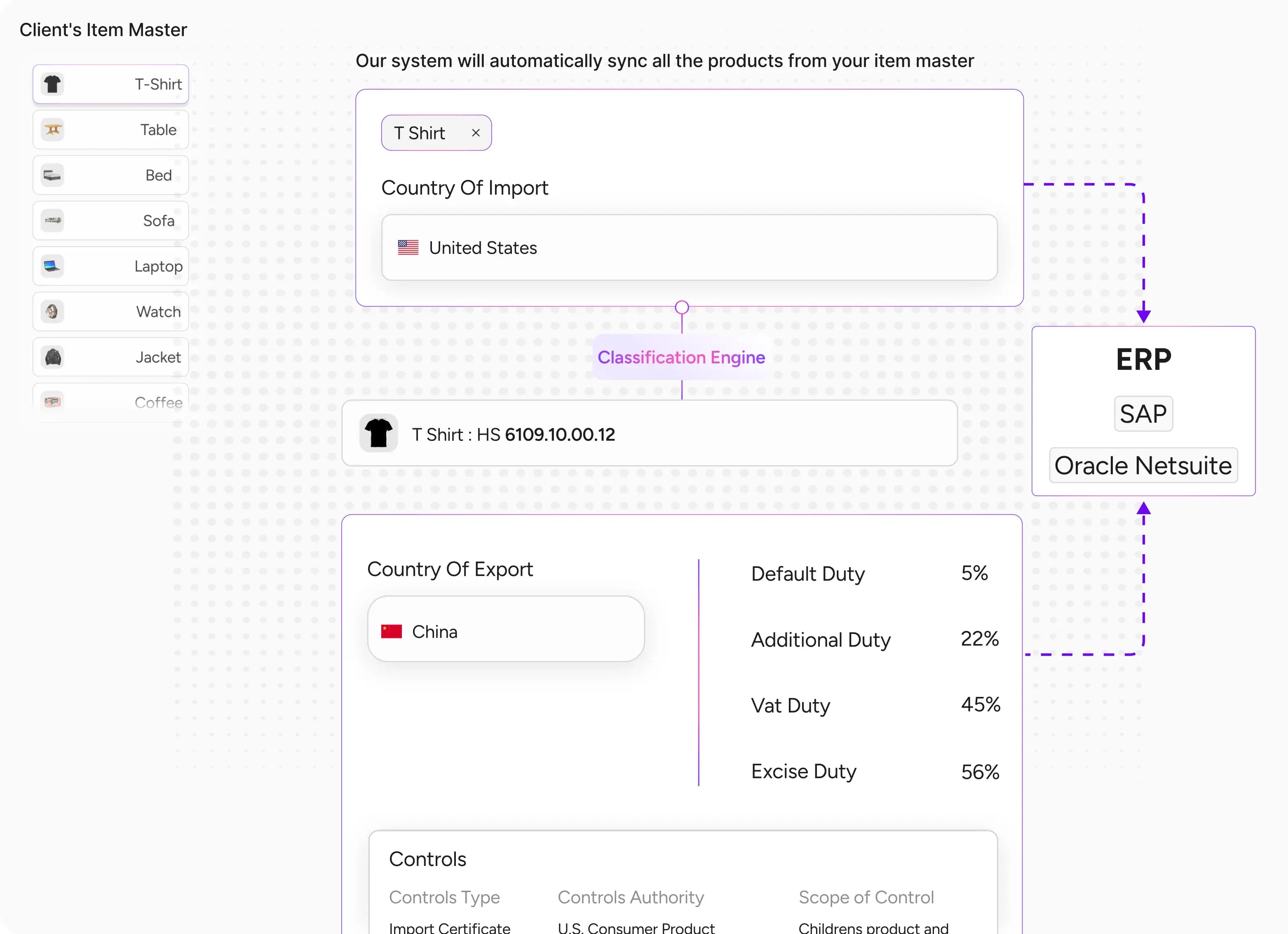

ExploreProduct Master

Centralize all product attributes such as HS codes, origin, and licensing within a single, unified engine. Eliminate data silos, streamline SKU onboarding, and ensure every team works with consistent, accurate trade classification data across the globe.

ExploreLanded Cost Calculator

Calculate the full landed cost of your shipments using real-time data from over 140 countries. The tool considers duties, tariffs, taxes, freight, and Free Trade Agreements to provide a clear, accurate cost breakdown—helping you price and plan with confidence.

ExploreEverything you need for global trade compliance, all in one place.

140+

Countries Covered

880K+

Tariffs, Controls, and Duties

500,000+

Customs Rulings

Daily

Update Frequency