Experience AI-Powered Sanctions Screening

Ensure the legal and reputational safety of your business by performing robust due diligence and effectively screening business partners, prospects, customers, vendors, and visitors for denied and restricted parties against 660+ global sanctions and PEP lists.

Reliable and Regularly Updated Sanctions and PEP Lists

475

Sanctions Lists

190+

PEP Lists

955k+

Active Sanctioned Entity Records

390+

Sanctions Sources

6

Hours Update Frequency

Proactive Due Diligence and Risk Mitigation

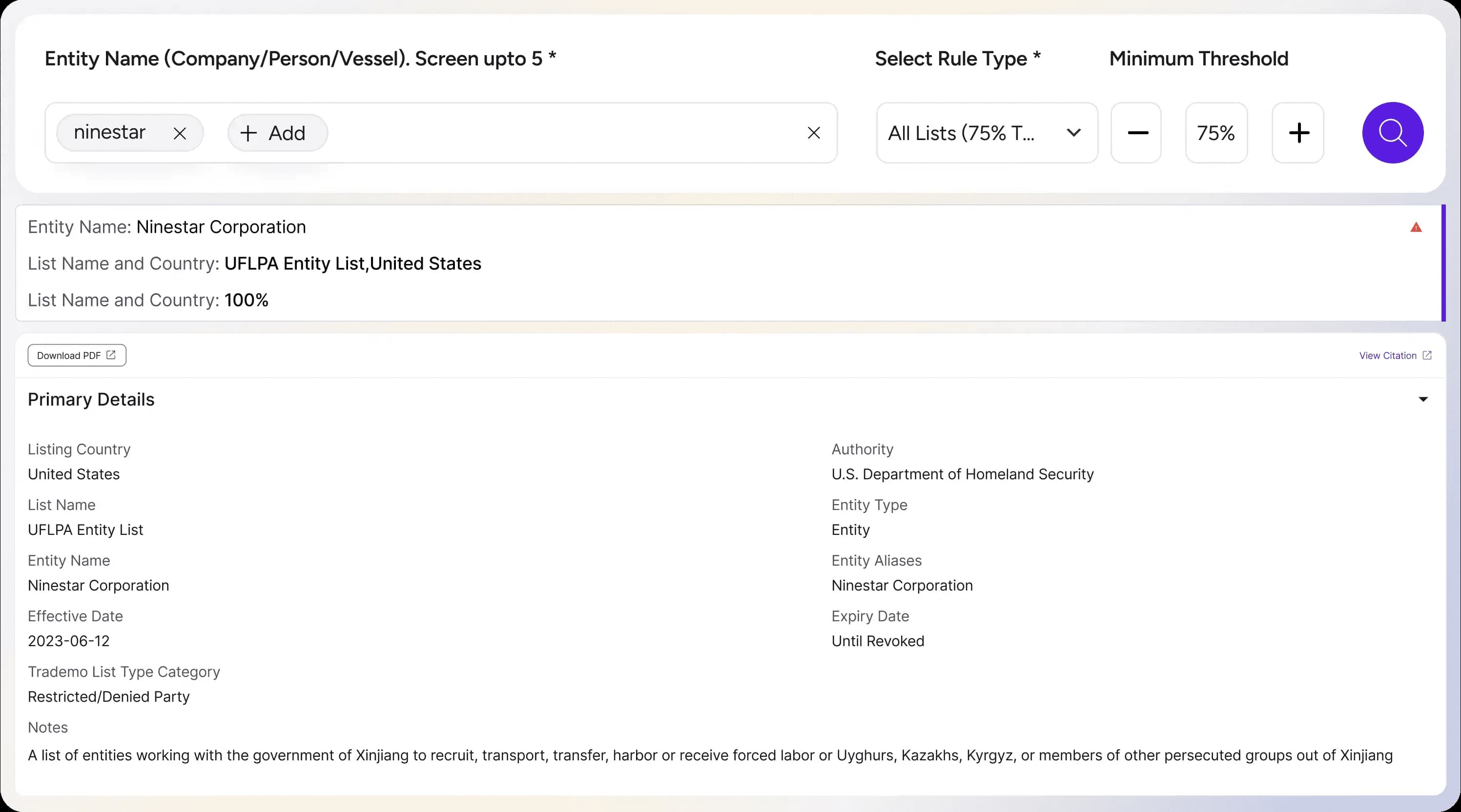

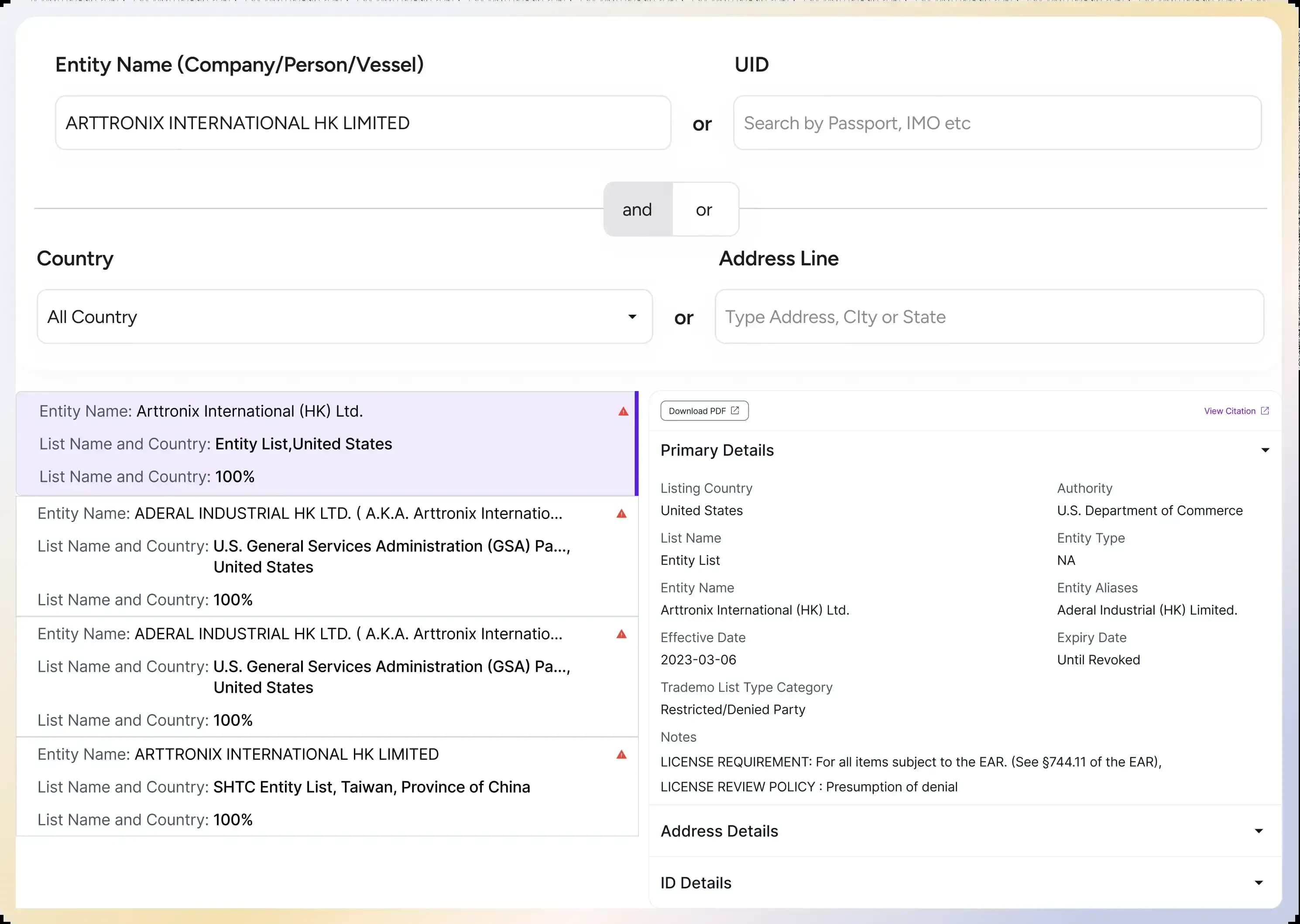

Denied & Restricted Party Screening with Advanced Capabilities

Industry-Leading Name-Matching Technologies

Most Demanded Sanctions Lists in One Place

Explore Transformation Stories

Advanced Yet Simplified Sanctions Compliance

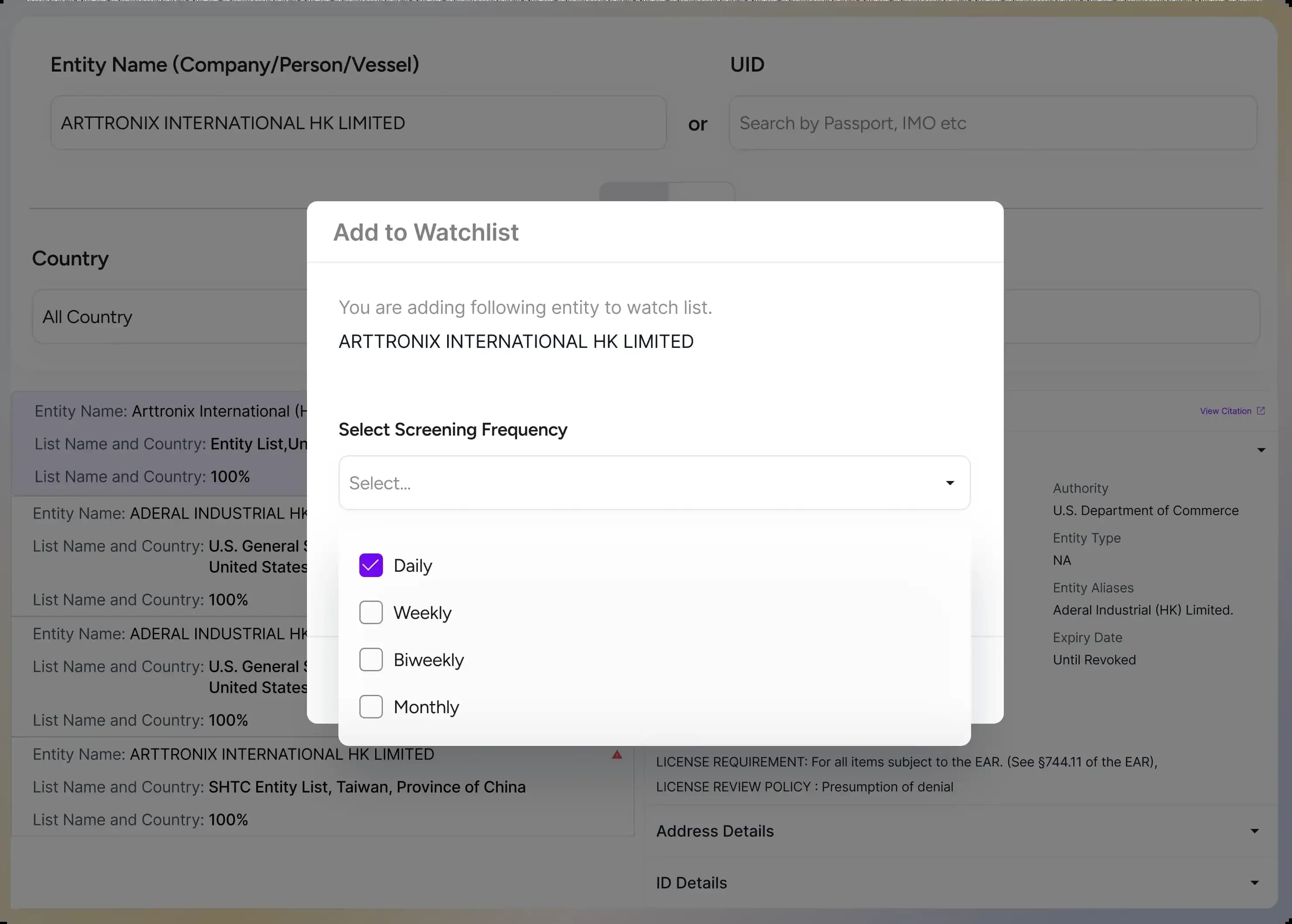

Alerts on Saved Searches

Get alerts for updates on new sanctions information and embargoes directly into your inbox for your sanction or global watchlist searches on Trademo's sanctioned screening platform.

Fast Onboarding

Trademo sanctions screening software provides you with a simple and easy-to-use interface to ensure hassle-free sanctions compliance with effective denied and restricted party screening.

Global Sanction Lists Coverage

Get access to over 645 cleansed and enriched global sanction lists and PEP lists. These lists include well-refined and structured OFAC, United Nations, and EU lists to name a few for performing sanctions check.

Quick & Easy Integrations

You can easily integrate Trademo's restricted party screening software with your existing procurement software tools to streamline your KYC and AML compliance processes.

Explore Our Advanced Trade Compliance Content

Global Sanctions Lists

Screen restricted parties from a global database for OFAC sanctions, EU sanctions, SDN sanctions, and more.

PEP Sanctions Lists

Leverage a global PEP database to assess sanction risks, manage clients, and meet KYC/AML compliance norms.

Banking Sanctions Lists

Verify businesses/individuals and conduct sanctions audits against global banking & financial sanctions listings.

Healthcare Sanctions Lists

Identify sanctioned entities from a vast database of healthcare sanction lists by the government and related authorities.

OFAC Sanctions Lists

OFAC Sanctions encompass individuals, banks, businesses, and organizations sanctioned by the U.S. government.